"Gas costly, even with oil boom"

Jonathan Fahey

March 22nd, 2013

Atlanta Journal Constitution

Jonathan Fahey

March 22nd, 2013

Atlanta Journal Constitution

I chose this article because it discusses an issue that affects the majority of Americans.

-Crude oil-Crude oil naturally occurs and can be refined to make usable products.

-Brent crude- Brent crude is a benchmark to price oil in the Middle East, Europe, and Africa that is exported west.

-Nonrenewable resources-Nonrenewable resources have a fixed quantity such as coal, oil, and natural gas.

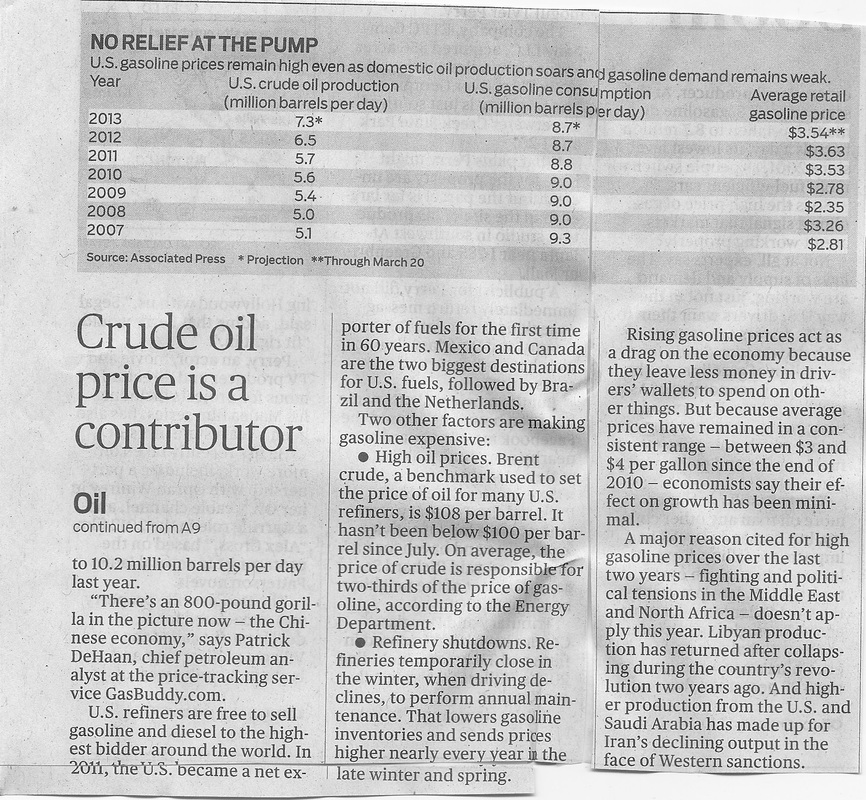

This article covers the rise in gas prices despite an increase in oil production in the United States. Last year, the U.S. had its largest increase in oil input yet gas prices are likely to approach $4 by May.The article describes how U.S. drivers compete worldwide for gas, particularly with China. This competition along with increased demand in Latin American countries drives prices up. U.S. refineries are also able to sell he oil internationally, as displayed by our transition to a net exporter for the first time in 2011. The article gives to additional reasons for high gas prices: high oil prices based on brent crude and the closing of refineries during the winter which lowers inventories. Fahey also describes how a major reason for high gas prices in recent years, tension in the Middle East, is not a cause in this year's increase.

This article shows how even though oil production in the U.S. rises, gas prices do not fall. This constant rise in price is not good for individual Americans or the economy as there is not as much money to spend on other products. We should focus on developing alternative energy sources to reduce reliance on oil. This will reduce greenhouse gas emissions from the combustion of fossil fuels.